Merger and acquisition activity in the US wealth management sector remained brisk in the first half of 2022, as a battle to stay competitive, build scale and future-proof business against volatility arguably fueled deals, figures suggest.

According to ECHELON Partners, a Los Angeles-based firm advising the sector on corporate finance, a record 181 deals were announced in H1 2022, and the firm expects a total of 308 deals for the year under existing market conditions.

The firm’s report said that strategic acquirer and consolidator businesses were still the dominant M&A players, coming out with 46 per cent of deals since the start of this year. The “Other” category of firms was also prevalent in the second quarter driven by direct private equity investments as well as significant activity from large Independent broker dealers. This category accounted for 36 per cent of all AuM transacted.

Significant transactions in the “Other” category include Genstar Capital’s recapitalization of Cerity Partners, two acquisitions by Advisor Group , and Bain Capital’s and JC Flowers’ investment in $13 billion Insigneo Financial Group, ECHELON said.

As regularly pointed out by Family Wealth Report, the M&A activity is driven by various forces: Desire for scale – to deal with rising regulatory costs, digitalization and client expectations – a trend of advisors heading toward retirement, and hunger to tap multi-trillion dollar intergenerational wealth transfer. FWR correspondent Charles Paikert in February this year pointed out the importance of private equity in the wealth M&A space – not always an easy relationship.

Deals and details

ECHELON said deal volume in H1 2022 rose 39.2 per cent on a year ago; there were 33 more deals announced in the second quarter of this year than a year ago.

Buyers during Q2 included Genstar Capital, Bain Capital, Advisor Group, Kennedy Lewis, Morningstar, First Citizens Bank, JC Flowers. AssetMark, and The Vistria Group.

The firm said private equity-to-private equity transactions are the most likely outcome for large RIA recapitalizations, as in the case of Cerity Partners.

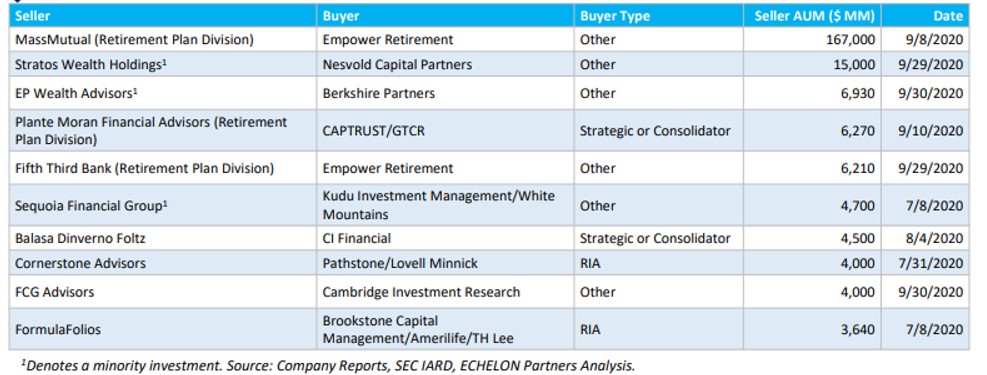

Large deals in Q2 2022